Out Of Province Course

Out of province but looking to Practice in Mortgages in Ontario? This course is for you!

This 2-hour course covers the legal and regulatory framework that applies to mortgage brokering in Ontario.

For more information on the licensing requirements for out of province applicants, please consult FSRA’s website:

Pricing

$150.00 (HST exempt)

Completion of the course

- You must successfully pass the course completion quiz by achieving a minimum score of 70%.

- The course completion quiz consists of 20 multiple choice questions, and you will have unlimited attempts.

What the course includes

- Access to online course

- Final examination

- Certificate of Course Completion and Transcript

Refund Policy

- No refund shall be given beyond 5 days of registration or if the first module has been opened.

- If within 5 days and no modules have been opened, a refund will be given minus 25% Administration Fees.

Learner Code of Conduct

When you start the course, you will be required to review and attest that you abide by CMBA Ontario’s Learner’s Code of Conduct: Click Here

Accommodation, Complaints, and Privacy Policies

- We are happy to provide accommodations to meet your unique needs. Please contact CMBA Ontario at office@cmbaontario.ca to make a request.

- Should you have a complaint regarding the Course, the process, or another concern please submit your concerns to our Executive Director: Please include your Name, Contact Information & the details of your concern within your email.

- We are committed to protecting the privacy of the personal information on CMBA Ontario’s members and students enrolled in CMBA Ontario’s courses. Review our privacy policy for more information.

The mortgage Agent Course (MAC) will soon be called Mortgage Agent Level 1 or MAL1.

What is a Private Mortgage?

A private mortgage is a type of mortgage loan whereby funds can be sourced from another person or business rather than borrowing from a bank or other financial institution.

Areas of focus: Following guidance from the Mortgage Broker Regulators’ Council of Canada (MBRCC) and the Financial Services Regulatory Authority of Ontario (FSRA), the course will follow these eight areas of focus:

1. General – Introduction to Private Mortgages

2. Private Mortgages Transaction Process

3. Working for the Borrower

4. Working for the Lender/Investor

5. Working for Both the Borrower and the Lender/Investor

6. Understanding Mortgage Administration

7. Detecting and Preventing Mortgage Fraud

8. Ethics and MBRCC National Code of Conduct for the Mortgage Brokering Sector

In April 2022, the government and FSRA implemented new licensing classes with enhanced educational requirements for brokers and agents working with private mortgage lenders and raising capital. This initiative supports the Ontario government’s direction to introduce licensing categories that better respond to the unique practices required by certain segments of the mortgage market, and enhance competency in the mortgage brokering sector to better protect consumers.

What is a Private Lender?

A private lender is a person or business that loans money to someone but is not connected to a financial institution such as a bank, credit union, finance company, or NHA-approved lenders. Private lenders can be a relative, a friend or colleague, or someone you don’t even know.

What will change?

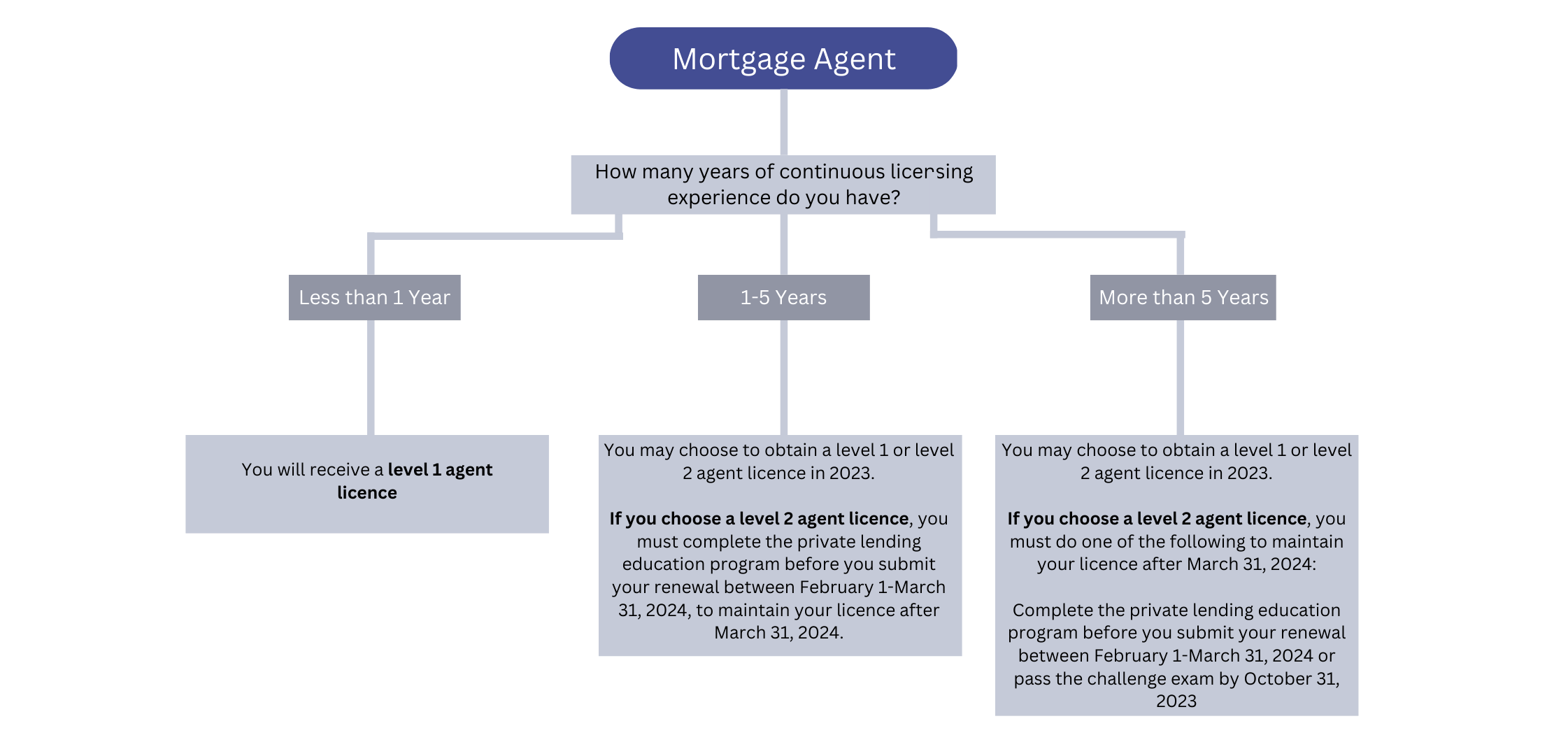

Effective April 1, 2023, there will be two licensing classes for mortgage agents as follows:

- Level 1 – agents are authorized to deal and trade in mortgages with financial institutions or approved by the Canada Mortgage and Housing Corporation (CMHC) approved lenders under the National Housing Act

- Level 2 – agents are authorized to deal and trade in mortgages with mortgage lenders, including private individuals.

Full details can be found on FSRA’s information and resource page, including the official Guidance.

To demonstrate their competency in dealing and trading in private mortgages, mortgage brokers, including principal brokers and agents who want to hold a level 2 licence, will need to complete and pass the Private Mortgages Course approved by FSRA. Brokers and agents who have five years of continuous licensing experience may choose to write the Private Mortgages Course Challenge Exam in place of completing the course.

The objective of the course and exam is to ensure that licensees have enhanced knowledge about the regulatory framework, transaction processes and risks (including risk of fraud) associated with private lending.

Key dates

- Early 2023 – Private Mortgages Course and Challenge Exam available

- October 31, 2023 – deadline to pass the Private Mortgages Course Challenge Exam

- March 31, 2024 – deadline to complete the Private Mortgages Course

What this means for you

Existing brokers and agents who are eligible and wish to hold a level 2 agent or broker licence must successfully pass the Private Mortgage Course or the Challenge Exam before the deadlines. Licensees that do not pass the Challenge Exam by October 31, 2023, must complete and pass the Private Mortgage Course by March 31, 2024. Those who do not complete these requirements will transition to a Level 1 agent licence on April 1, 2024.

If a principal broker does not successfully complete the course or the exam, its mortgage brokerage must appoint another principal broker who has the appropriate experience and educational requirements.

Be sure to watch for more updates on this important initiative from FSRA, including course availability and an industry webinar.