Private Mortgages Course

FSRA accredited course for the Mortgage Agent Level 2 Licence

FSRA accredited course for the Mortgage Agent Level 2 Licence

The CMBA Ontario Accredited Private Mortgages Course provides active mortgage agents in Ontario with the knowledge and skills they need to effectively transact with Private Lenders.

This course is accredited by the Financial Services Regulatory Authority of Ontario (FSRA) and adheres to the Mortgage Broker Regulators Council of Canada (MBRCC) accreditation standards.

You must successfully pass the final examination online to complete the course. The examination consists of 50 questions and a score of at least 70% is required. Results will be provided within 3 business days after the completion of the final examination.

Take the course with one of our Facilitators, or on your own through our Self-Study option.

Learning Outcomes

The course is designed to align with FSRA’s learning outcomes:

- Education/competency requirements that better align with activities in the mortgage market

- Enhanced consumer protection as borrowers and lenders / investors receive appropriate levels of information and recommendations to make informed decisions relevant to their mortgages / mortgage investments

- Enhanced confidence in the mortgage brokering industry as licensees are prepared for their career in the mortgage brokering sector

Timelines

Online/Self-Study:

- Timeline: You have 6-months to complete your review of the course material and write the exam.

- Extension: You may purchase extensions in increments of 2-months for $75 +HST, up until a maximum of 12 months.

- Maximum timeline: 12-months. If you cannot complete the exam within 12 months, you will need to take the course again and pay the course fee in full.

In-Class: Virtual Classroom/In-Person

- Timeline: You must write the final exam within 7 days of the last day of class

- Extension: You may extend by another 7 days at no cost. Any further extensions may be subject to a fee of $75 +HST. Please contact us at office@cmbaontario.ca to inquire.

- You may reschedule your class if it has not yet started at no cost

Final Examination

- Timeline: 3 hours maximum to write the exam, in one sitting

- Final examination will be proctored virtually using an online application

- You must have a webcam, microphone, speakers, and share screen enabled during the exam

In-Class Details

Experience the in-class setting from the comfort of your own home or office in our Virtual Classroom, or physically in-person at CMBA Ontario’s Head Office located at 40 Winges Road, Unit 7, Woodbridge, Ontario, L4L 6B2.

Instructed by experienced mortgage industry professionals, and includes lectures, class discussions, group problem solving and case studies.

We have 3 different class options to accommodate your work/family schedule: Monday-Friday, 2 consecutive weekends, or 2 days over 2 weeks. Classes run from 9:00AM to 4:00PM each day

Price:

Member: $299 (HST exempt)

Non-Member: $349 (HST exempt)

Members must use a coupon when paying for the course to activate the reduced cost. Get the coupon by logging into the Member Portal here: https://members.cmbaontario.ca/

Students will be given 2 breaks and 1 lunch break each day. The instructor will go through all the chapters during class, including PowerPoint presentations and quizzes that will be done as a class and on your own time. Attendance is mandatory, to successfully fulfil FSRA’s requirements for the Mortgage Agent Level 2 Certification. The instructor will also provide their contact information if the students have any questions while studying at home.

Students must complete the online exam within 7 days after the last class. An extension of 7 days may be provided. Any further extensions may be subject to a rescheduling fee of $75 + HST.

An electronic textbook will be emailed to students prior to the first class.

The course content and exam are the same for all formats. Everything covered in the assigned chapters and by the instructor constitutes part of the subject content and is eligible for inclusion on the final examination.

It is ESSENTIAL that students read the assigned material before class and make careful notes on the reading material as well as in-class lectures and discussion.

NOTE: In order for a course to proceed, a minimum number of participants must be met. If the minimum number of registrants for the course dates you have chosen is not met, you can switch into an alternate date we are offering or into our online course.

Online/Self-Study

Take the course on your own time! Students can take up to 6 months from the date of registration to complete the online course and examination.

Students who are unable to complete the online course within the 6-month period, may request a 2-month extension for a fee of $75 plus HST. Students will be allowed to purchase an extension for 2-months for $75 +HST, up to the maximum of 12 months. If the course and exam are not completed within 12 months, the course must be purchased in full again.

Price:

Member: $299 (HST exempt)

Non-Member: $349 (HST exempt)

Members must use a coupon when paying for the course to activate the reduced cost. Get the coupon by logging into the Member Portal here: https://members.cmbaontario.ca/

Only once you have completed your review of the course content, you can access the final examination, which is proctored online.

Refund policy

Virtual or In-Class:

- Students who wish to cancel the course after purchase will receive a refund minus a 25% administration fee.

- There is no charge for re-scheduling.

- Refunds will not be available past the start date of the class.

Online/Self-Study:

- No refund shall be given beyond 5 days of registration or if the first module has been opened.

- If within 5 days and no modules have been opened, a refund will be given minus 25% administration fee.

CMBA Ontario Education Policies

Code of Conduct

Everyone taking a course at CMBA Ontario must adhere to the Learner’s Code of Conduct. You will need to attest that you adhere to the code.

Privacy Policy

We are committed to protecting the privacy of the personal information on CMBA Ontario’s members and students enrolled in CMBA Ontario’s courses.

Review our privacy policy for more information.

Accommodation Policy

CMBA Ontario is happy to make accommodations within reason for Learners with a valid accessibility need.

It is expected that at a minimum, all Learners who are registering for a CMBA Ontario course is able to successfully operate as a Mortgage Agent or Broker with these basic skills: fluency in English, comfortable with computers, able to navigate web browsers, and comfortable completing online forms/questionnaires.

Please contact CMBA Ontario at office@cmbaontario.ca to inquire about your specific accessibility accommodation.

Line D’Amour has been exceptional in her teaching and coaching for the Oriana Financial team of agents for the Private Mortgages Course. She definitely makes CMBA Ontario the best choice for this important Licence requirement.

-Mike Hall, Broker, Oriana Financial

Elizabeth provided real life examples to the Private Mortgages Course that made each subject easier to understand and remember, especially mortgage administration and the different types of private lender groups. Due to family and work I have always done just self-study courses but I am happy that I chose to take the class virtually, I learned a lot!

-Anne Perala, Principal Broker, Royal Financial Services Inc.

Tom facilitated excellent conversations that were educational and engaging during the Private Mortgages Course. The Admin team kept me in the loop with everything during the course and I got my exam results quickly. It was a pleasure being in a virtual classroom to be able to meet other agents/brokers in the industry and make new connections!

-Arlen Ekstein, Mortgage Agent Level 2, Tembo Financial Inc.

The Private Mortgages Course offered by CMBA Ontario provided great insight into Private Mortgages. The course was well-designed and organized in a way that reinforces the fundamental knowledge of the Private Mortgage space and also adds a practical application component to complement the learning concepts.

I was fortunate enough to have Elizabeth Gnoinski as the facilitator of the course; her knowledge in the area of Private Mortgages further brought the course to life.

I would recommend CMBA Ontario Mortgage Agent 2 course to enhance your career development path for those who seeking to offer Private Mortgages as part of their lending options.

-Darnell Charlemagne, Mortgage Agent, BRX Mortgage Inc., 13463

The mortgage Agent Course (MAC) will soon be called Mortgage Agent Level 1 or MAL1.

What is a Private Mortgage?

A private mortgage is a type of mortgage loan whereby funds can be sourced from another person or business rather than borrowing from a bank or other financial institution.

Areas of focus: Following guidance from the Mortgage Broker Regulators’ Council of Canada (MBRCC) and the Financial Services Regulatory Authority of Ontario (FSRA), the course will follow these eight areas of focus:

1. General – Introduction to Private Mortgages

2. Private Mortgages Transaction Process

3. Working for the Borrower

4. Working for the Lender/Investor

5. Working for Both the Borrower and the Lender/Investor

6. Understanding Mortgage Administration

7. Detecting and Preventing Mortgage Fraud

8. Ethics and MBRCC National Code of Conduct for the Mortgage Brokering Sector

In April 2022, the government and FSRA implemented new licensing classes with enhanced educational requirements for brokers and agents working with private mortgage lenders and raising capital. This initiative supports the Ontario government’s direction to introduce licensing categories that better respond to the unique practices required by certain segments of the mortgage market, and enhance competency in the mortgage brokering sector to better protect consumers.

What is a Private Lender?

A private lender is a person or business that loans money to someone but is not connected to a financial institution such as a bank, credit union, finance company, or NHA-approved lenders. Private lenders can be a relative, a friend or colleague, or someone you don’t even know.

What will change?

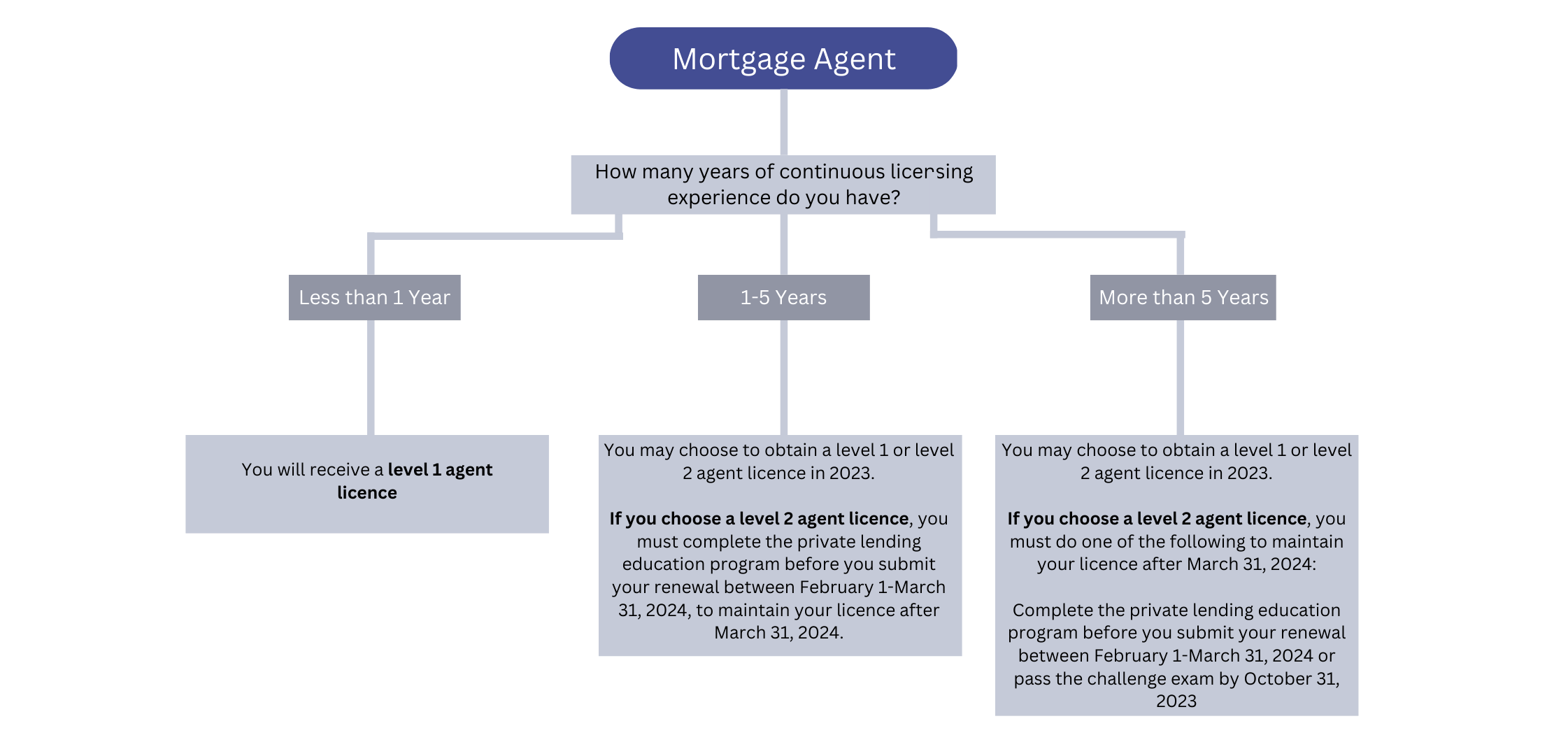

Effective April 1, 2023, there will be two licensing classes for mortgage agents as follows:

- Level 1 – agents are authorized to deal and trade in mortgages with financial institutions or approved by the Canada Mortgage and Housing Corporation (CMHC) approved lenders under the National Housing Act

- Level 2 – agents are authorized to deal and trade in mortgages with mortgage lenders, including private individuals.

Full details can be found on FSRA’s information and resource page, including the official Guidance.

To demonstrate their competency in dealing and trading in private mortgages, mortgage brokers, including principal brokers and agents who want to hold a level 2 licence, will need to complete and pass the Private Mortgages Course approved by FSRA. Brokers and agents who have five years of continuous licensing experience may choose to write the Private Mortgages Course Challenge Exam in place of completing the course.

The objective of the course and exam is to ensure that licensees have enhanced knowledge about the regulatory framework, transaction processes and risks (including risk of fraud) associated with private lending.

Key dates

- Early 2023 – Private Mortgages Course and Challenge Exam available

- October 31, 2023 – deadline to pass the Private Mortgages Course Challenge Exam

- March 31, 2024 – deadline to complete the Private Mortgages Course

What this means for you

Existing brokers and agents who are eligible and wish to hold a level 2 agent or broker licence must successfully pass the Private Mortgage Course or the Challenge Exam before the deadlines. Licensees that do not pass the Challenge Exam by October 31, 2023, must complete and pass the Private Mortgage Course by March 31, 2024. Those who do not complete these requirements will transition to a Level 1 agent licence on April 1, 2024.

If a principal broker does not successfully complete the course or the exam, its mortgage brokerage must appoint another principal broker who has the appropriate experience and educational requirements.

Be sure to watch for more updates on this important initiative from FSRA, including course availability and an industry webinar.